34+ income to debt ratio for mortgage

Were Committed To Giving You The Mortgage Solution You Need To Achieve Your Goals. Web What is DTI what does it mean for your FHA loan and what are the compensating factors.

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Generally lenders prefer your back-end ratio to be below 36 but some will allow up to 50 when applying for a.

. Ad We Offer The Competitive Mortgage Rates You Want And The Superior Service You Deserve. Web How to lower your debt-to-income ratio. Web Your debt-to-income ratio DTI compares how much you owe each month to how much you earn.

Ad Learn More About Mortgage Preapproval. Lets break it down. Ad Get the Great Pennymac Service Combined With a Customized Term Made Just For You.

Web Our standards for Debt-to-Income DTI ratio. Compare Now Find The Lowest Rate. Your DTI or debt-to-income ratio is based on two numbers.

Your total debt divided by your gross monthly income. For example if you pay. Specifically its the percentage of your gross monthly income be.

Browse Information at NerdWallet. Web How to calculate your debt-to-income ratio. Web Here are debt-to-income requirements by loan type.

Ad Compare Mortgage Options Calculate Payments. Lower your monthly debt obligations. To get the back-end ratio add up your other debts along with your housing expenses.

Ad How Much Interest Can You Save By Increasing Your Mortgage Payment. Compare Mortgage Options Get Quotes. Find out what debt-to-income ratio is and how you can lower it.

Web Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income. Once youve calculated your DTI ratio youll want to understand how lenders review it when theyre considering your application. Web These sources may include wages salary bonuses and commission just to name a few.

Ad We Offer The Competitive Mortgage Rates You Want And The Superior Service You Deserve. Finance Your Dream Home with the Lowest Rates. When a low DTI helps.

To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments. Web Debt-To-Income Ratio - DTI. Web Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out.

1 Add up the amount you pay each month for debt and recurring financial obligations such as credit cards car. Web What is the debt-to-income ratio to qualify for a mortgage. Get Started Now With Quicken Loans.

Apply Now With Quicken Loans. See If Youre Eligible for a 0 Down Payment. Answer Simple Questions See Personalized Results with our VA Loan Calculator.

View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments. Were Committed To Giving You The Mortgage Solution You Need To Achieve Your Goals.

Ad Use Our Comparison Site Find Out How to Get Home Loan Pre Approval In Minutes. Web The lower your debt-to-income ratio the better mortgage rate youll get. DTI is a key ingredient in home affordability for many borrowers.

Im using some online mortgage affordability calculators just to get a sense of how much I would be approved for a loan. If your home is highly energy-efficient. Ad Get the Best Rates For Your Mortgage Compare Top Companies and Get Great Deals.

Mortgage lenders are particularly cognizant of applicants debt. Find A Lender That Offers Great Service. Calculate Your Monthly Loan Payment.

Skip to content Main. Compare More Than Just Rates. Youll usually need a back-end DTI ratio of 43 or less.

Web What is debt-to-income ratio and why does it matter when you apply for a mortgage. Get Instantly Matched With Your Ideal Home Loan Lender. Web Your debt-to-income ratio is 15004500 or 333.

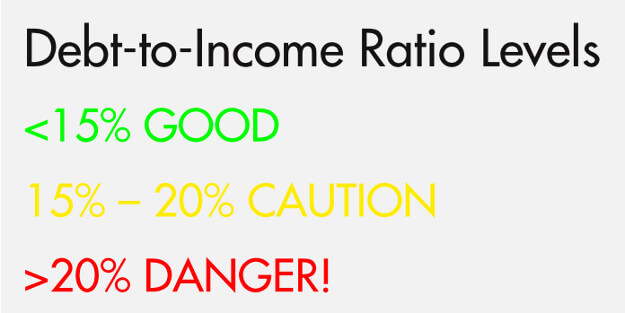

Lenders prefer to see a debt-to. Web Debt to Income Ratio for Mortgage Purposes. Why Your Debt-to-Income Ratio Matters.

Choose a Loan That Suits Your Needs. Web Lenders calculate your debt-to-income ratio by using these steps. Receive 1000 Off On Pre-Approved Loans.

Web How to calculate debt-to-income ratio. Once youve determined your total monthly debt payments and gross monthly income. Temporarily prioritize debt payments over savings and investment account.

The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall. Web Your front-end or household ratio would be 1800 7000 026 or 26.

Pdf Low Income Students Human Development And Higher Education In South Africa

Loan Page 6 Sun Pacific Mortgage Real Estate Hard Money Loans In California

What S An Ideal Debt To Income Ratio For A Mortgage

What Is The 28 36 Rule Lexington Law

Debt To Income Ratio Calculator Nerdwallet

Pdf International Journal Of Business And Management Vol 5 No 2 February 2010 All In One Pdf File Arash Shahin Academia Edu

Ex 99 1

Defining Debt To Income Ratios For A Mortgage Debt To Income Ratio

How Accurate Is Credit Karma Reviews Safety And Other Things To Know

Debt To Income Dti Ratio Requirements For A Mortgage

Debt To Income Dti Ratio Calculator Money

Debt To Income Ratio Calculator How To Calculate Your Ratio

Why Mortgage Applications Get Rejected What To Do Next

Debt To Income Ratio Dti What It Is And How To Calculate It

What Should Be My Financial Planing At The Age Of 25 Quora

How To Calculate Debt To Income Ratio For Mortgage More Mmi

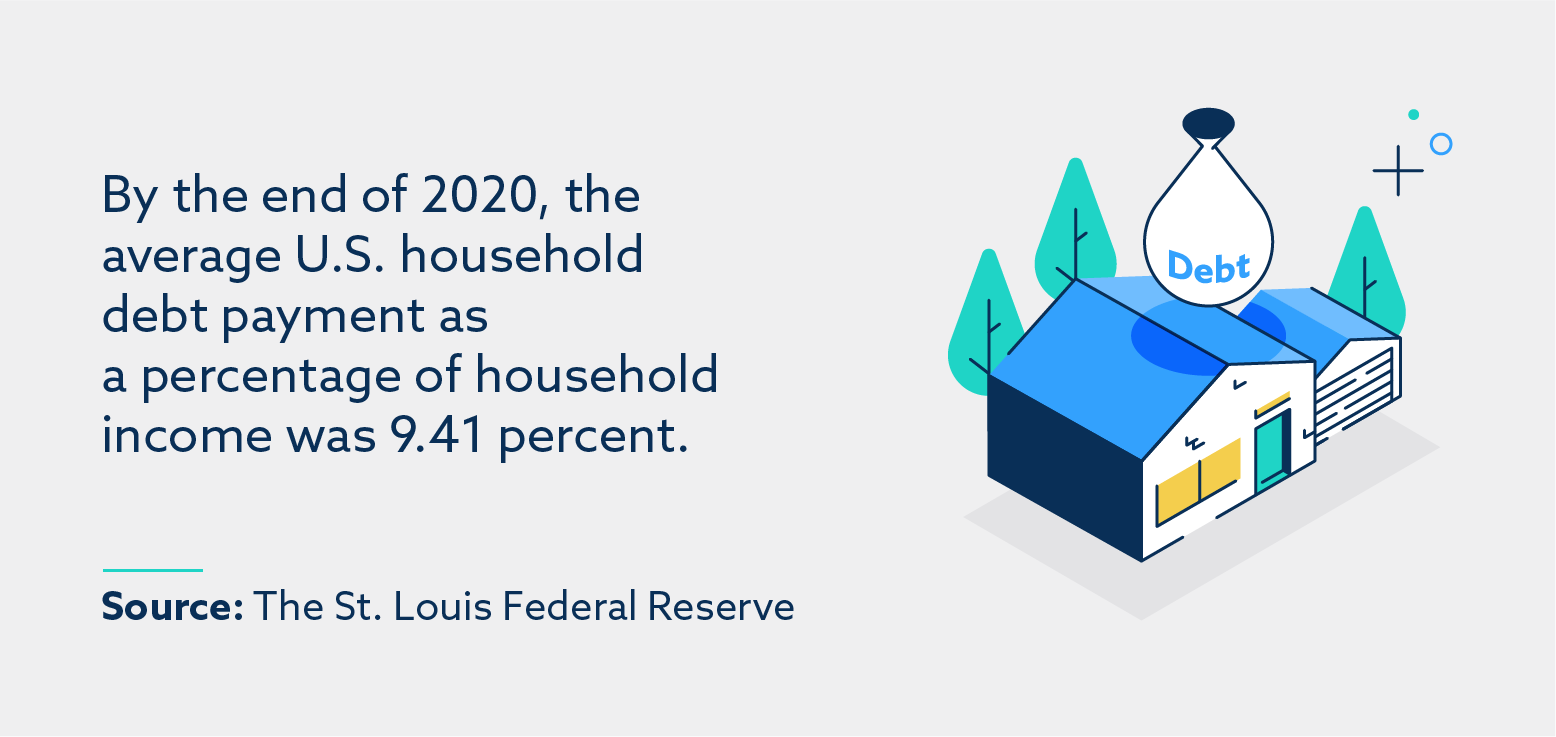

The Household Debt Ratio Is An Unsuitable Risk Measure There Are Much Better Ones Lars E O Svensson