Retirement income tax calculator 2021

For instance a person who makes 50000 a year would put away anywhere. However you can deduct RRSP contributions to reduce your income tax bracket.

How Is Taxable Income Calculated How To Calculate Tax Liability

Ad Looking for retirement tax calculator.

. This rule suggests that a person save 10 to 15 of their pre-tax income per year during their working years. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. Ad Use our free retirement calculator and find out if you are prepared to retire comfortably.

In retirement both plans distribute taxable funds usually to retirees who are in lower income tax brackets. And is based on. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Lets say your effective state tax rate in one of these states is 4 and your annual income from your 401k is 30000. Based on your projected tax withholding for the year we can also estimate. These calculators will help you estimate the level of monthly savings necessary to make it to retirement and can also help you predict how your investments can boost retirement returns.

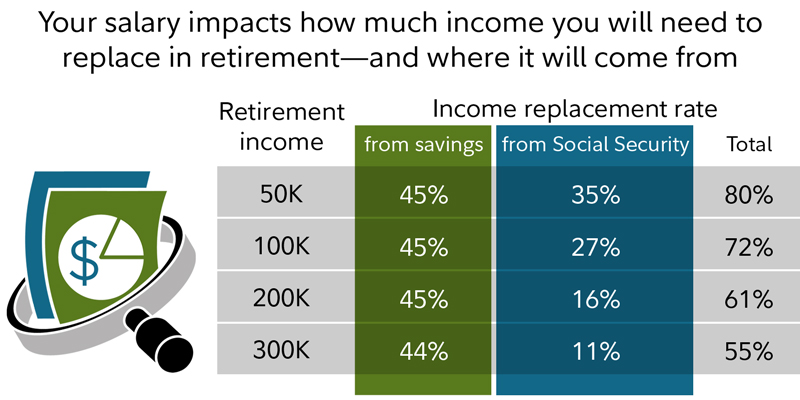

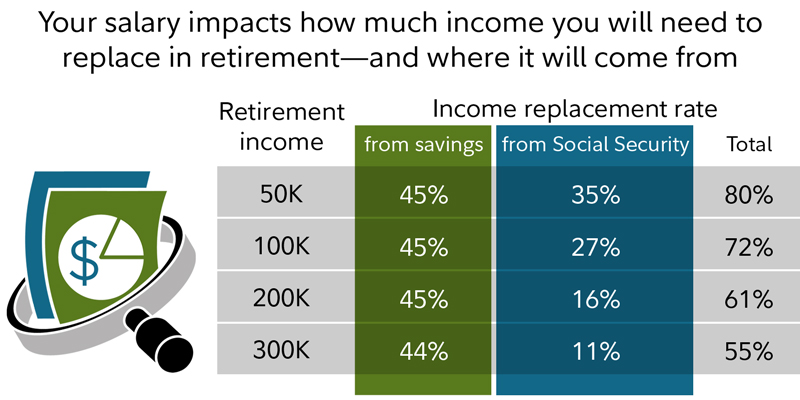

It is also possible to make a maximum contribution to both within the same tax year. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. The percent of your working years household income before tax you think you will need to have in retirement.

In 60 seconds calculate your odds of running out of money in retirement. More than 44000 up to 85 percent of your benefits may be taxable. In 60 seconds calculate your odds of running out of money in retirement.

Determine your current annual salary according to various localities. WASHINGTON The new Tax Withholding Estimator launched last month on IRSgov includes user-friendly features designed to help retirees quickly and easily figure the. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. For example in the 2021 tax season if you earn 80000 you will be in the 49020 to 98040. Use Our Retirement Advisor Tool To Help Determine Your Retirement Income Goals.

Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. Dont Wait To Get Started. We have the SARS tax rates tables.

Your household income location filing status and number of personal. That would add up to taxes of 1200 on that retirement account. Content updated daily for retirement tax calculator.

The Federal Ballpark Etimate. Enter your filing status income deductions and credits and we will estimate your total taxes. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Ad TIAA Can Help You Create A Retirement Plan For Your Future. It is mainly intended for residents of the US. Retirement income calculator Your retirement is on the horizon but how far away.

General Schedule GS Salary Calculator. Ad Use our free retirement calculator and find out if you are prepared to retire comfortably. This amount is based on your income earned during the last year you will work.

Includes projected Federal annuity and Thrift. You can use this calculator to help you see where you stand in relation to your retirement goal and map out.

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Tkngbadh0nkfnm

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Tax Calculator Estimate Your Income Tax For 2022 Free

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Ohio Retirement Tax Friendliness Smartasset

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Social Security Benefits Tax Calculator

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How To Calculate Federal Income Tax

What Will My Savings Cover In Retirement Fidelity

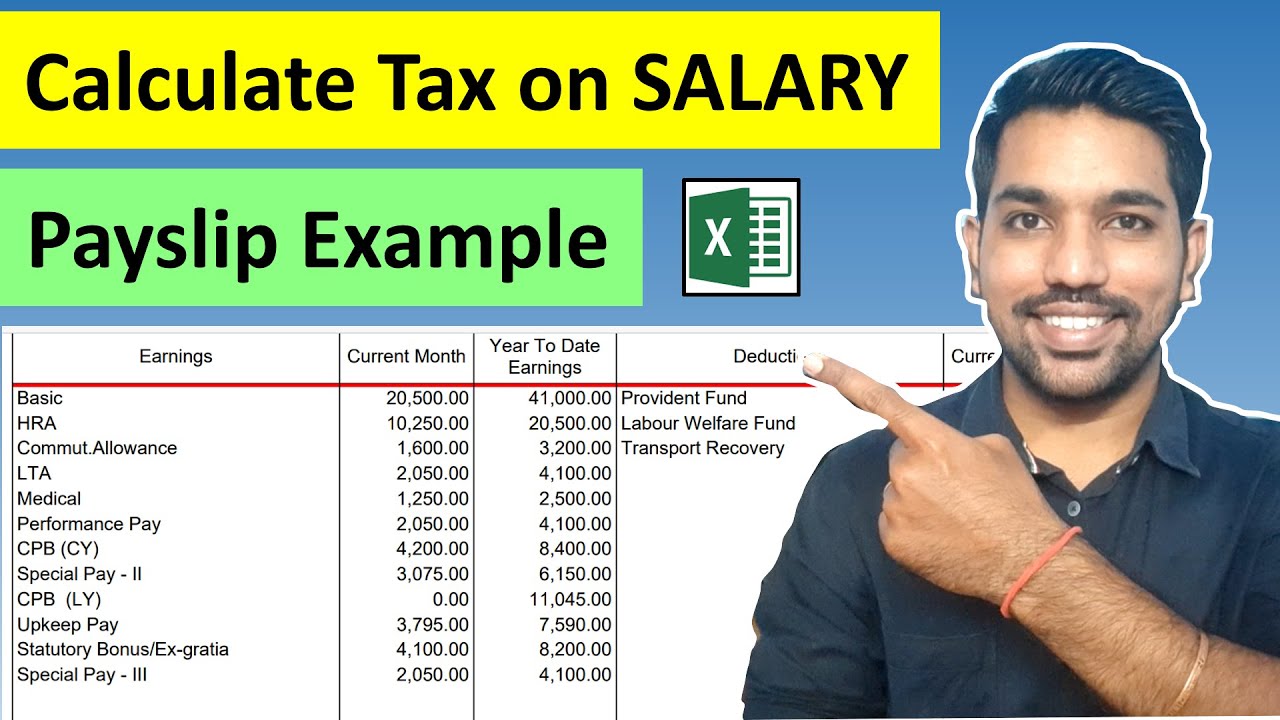

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

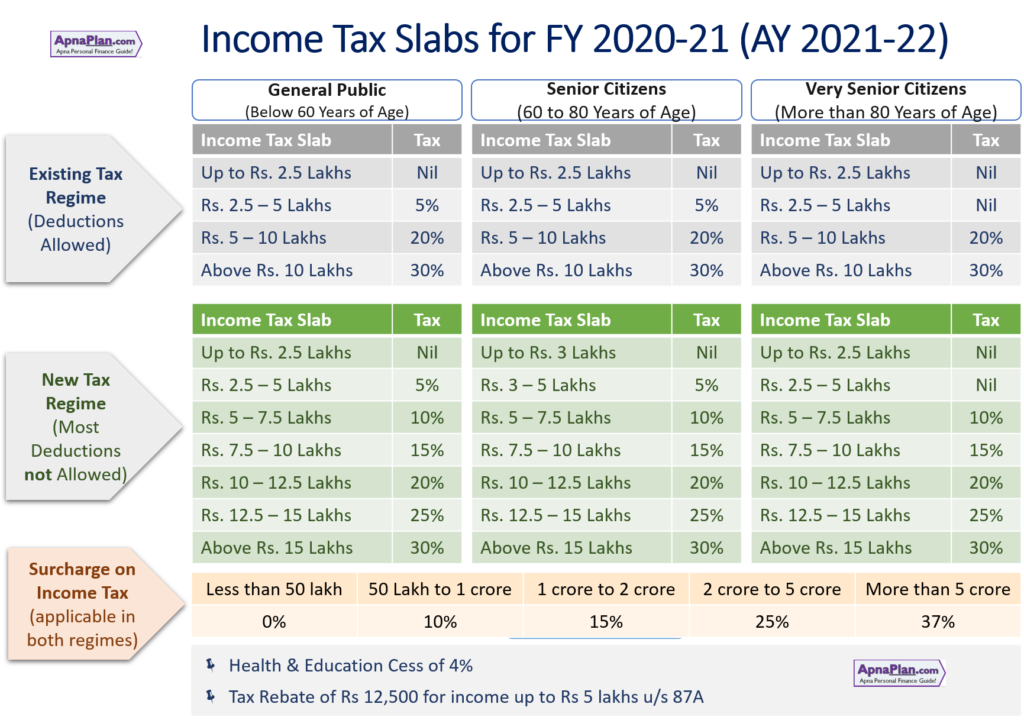

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

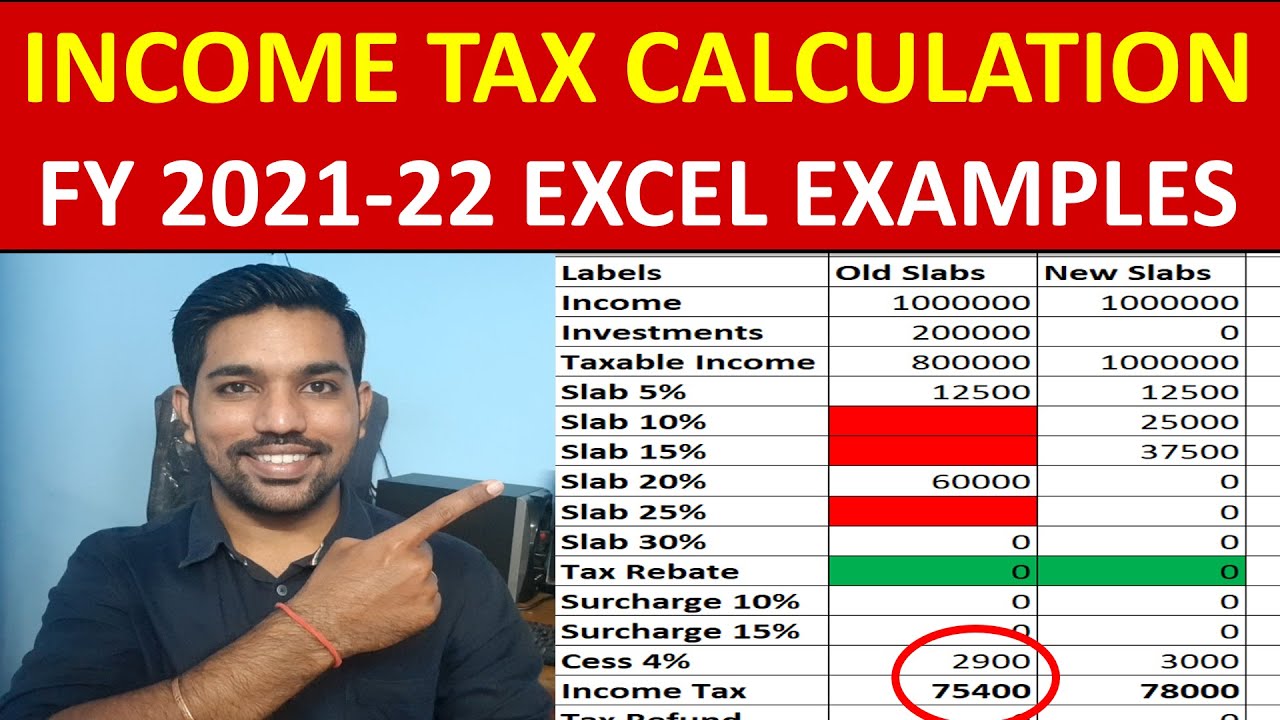

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Tax Withholding For Pensions And Social Security Sensible Money

Tax Withholding For Pensions And Social Security Sensible Money